Pandemic Support Update

Job Support Scheme

The Coronavirus Job Retention Scheme is due to come to an end at 31 October and it has recently been announced that the Job Support Scheme will be its successor, starting on 1 November for six months. The Job Support Scheme aims to protect jobs which will face lower demand throughout the winter months as a result of Covid-19.

To qualify the employee must work at least 20% of their usual hours and be paid for these hours by their employer. For the contracted hours which the employee does not work, the employer must pay for just 5% of these hours, with the government providing a grant for the remainder. This means that if someone was being paid £587 for their unworked hours, the government would be contributing £543 and the employer just £44. The employee must be registered on your PAYE scheme on or before 23 September 2020 and the employer will be required to pay the employees share of the unworked hours statutory National Insurance and pension contributions.

Ultimately, where the government contribution is not capped, this scheme will ensure that employees earn a minimum of 77% of their normal wages.

The scheme has recently been expanded to support businesses who are required to close their premises due to restrictions imposed by the government. Under the expansion, firms whose premises are legally required to shut for some period over the winter will receive grants to pay staff wages, up to £2,100 per employee, per month, as well as a cash grant of up to £3,000. The scheme starts on 1 November 2020 and is available to employers for six months.

Job Retention Bonus

The Job Retention Bonus is a one-off payment to employers of £1,000 for every employee who they previously claimed for under the Coronavirus Job Retention Scheme. To qualify, each employee must remain in continuous employment through to 31 January 2021 and earn at least £520 per month on average between November and January.

You will be able to claim for this one-off payment on the GOV.UK website from February 2021, and it can be claimed in conjunction with the Job Support Scheme outlined previously.

Self employed grant

A very recent announcement increases the amount of profits covered by the third self employed grant from 20% to 40%, meaning that the maximum grant will increase from £1,875 to £3,750. This is a potential further £3.1 billion of support to the self employed through November to January alone, with a further grant to follow covering February to April.

Tax Implications of Providing COVID-19 Tests and PPE to Employees

Revised guidance confirms that Covid-19 tests provided by the government as part of its national testing scheme are not treated as a benefit in kind for tax purposes. There is also no taxable benefit for antigen tests which are provided to employees outside of the government’s national testing system. This applies regardless of whether the tests are provided to the employees directly by the employer or whether the employer meets the cost of testing carried out by a third party.

Revised guidance confirms that Covid-19 tests provided by the government as part of its national testing scheme are not treated as a benefit in kind for tax purposes. There is also no taxable benefit for antigen tests which are provided to employees outside of the government’s national testing system. This applies regardless of whether the tests are provided to the employees directly by the employer or whether the employer meets the cost of testing carried out by a third party.

With the pandemic continuing to affect workforces around the country, the Chancellor has recently announced additional measures to protect businesses and their workforces over the winter months.

The current guidance does not include antibody tests or vaccine costs. If, however, the cost is less than £50 and the required criteria is met, it should be possible to provide these tax free under the existing trivial benefit exemption rules.

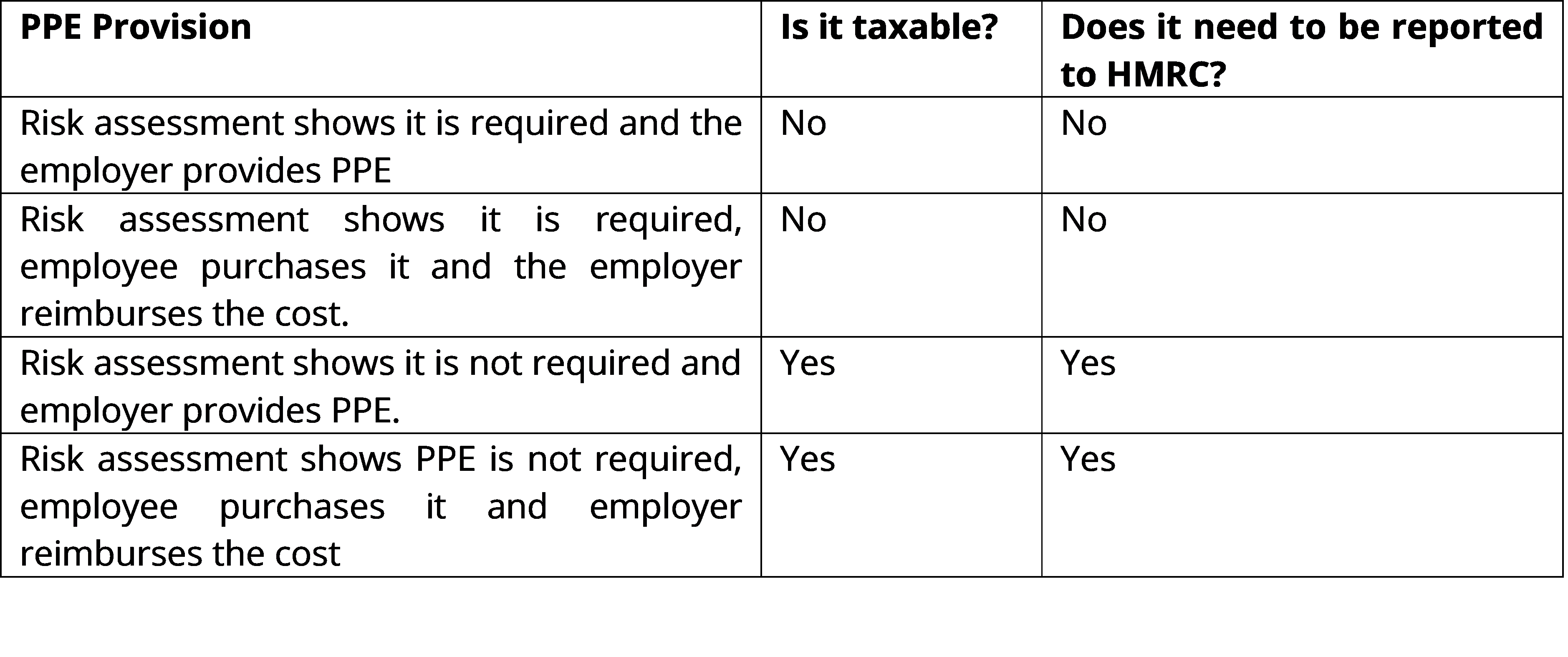

PPE could be taxable for your employees depending on the job they are undertaking and the risk assessment which has been carried out.

Working from Home

Employees are able to claim up to £6 per week, from April 2020, as reimbursement for the additional household expenses incurred due to working from home, for example, additional telephone or internet costs.

The payment, previously £4 per week, is non-taxable, with the taxpayer getting tax relief at the rate at which they pay tax. For example, if the employee pays the 20% tax rate and claims tax relief on £6 a week, they would get £1.20 per week in tax relief. Where the employer does not reimburse employees, employees can submit claims to HMRC to benefit from tax relief on homeworking expenses.

Alice Chapple FCCA ACIPP

Senior Manager

Alice joined Evolution ABS in July 2013 after completing her A Levels at the Woodroffe School. She has completed her AAT with Richard Huish College, and was nominated for higher apprentice of the year in Somerset and finished in the top 3. Alice became a fully qualified Chartered Certified accountant in May 2018, and has since completed her Payroll Technician Certificate and oversees our payroll department.

In her spare time, she is an active member of Axminster Young Farmers, and enjoys being in the countryside and walking her two dogs. She also enjoys helping her family and her husband on their dairy farms in East Devon.